When diving into the world of Forex trading, the platform you choose plays a pivotal role in your trading success. But what exactly is a Forex trading platform, and why is optimizing it so crucial?

What is a Forex Trading Platform

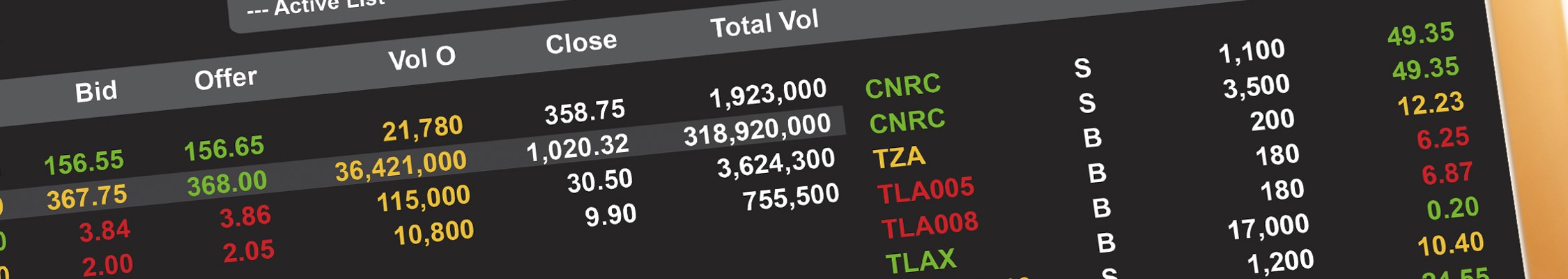

A Forex trading platform is specialized software that enables traders to buy and sell currencies online. Think of it as your trading cockpit, where you execute trades, monitor market movements, and make informed decisions. These platforms connect you to the Forex market, providing real-time data, charts, and various tools that help in analyzing currency pairs. Some platforms are desktop-based, while others are mobile apps, allowing you to stay connected to the market anytime and anywhere.

The features offered by Forex trading platforms can vary widely. Many provide advanced charting tools, indicators, and even social trading options that allow users to follow and copy the trades of successful traders. Additionally, a good platform will support various currency pairs and may also offer the ability to trade other financial instruments like commodities and stocks. Ultimately, the right trading platform becomes an ecosystem that supports traders at every stage of their trading journey.

Importance of Optimization in Forex Trading

Optimization of your trading platform is all about enhancing its functionality to maximize your trading potential. Just like tuning up a car can improve its performance, optimizing your trading platform can lead to better decision-making and potentially higher profits. An optimized platform can save you time, reduce stress, and ultimately help you make more informed trading choices. For instance, customizing your dashboard to show the most relevant information can help you stay focused on your trading strategy rather than getting bogged down by unnecessary data.

Moreover, a well-optimized platform allows traders to respond swiftly to market changes. With the fast-paced nature of Forex trading, even a slight delay can result in missed opportunities or losses. By optimizing your platform, you ensure that all the tools and resources you need are easily accessible, enabling quicker analysis and execution of trades. In essence, platform optimization not only improves your overall trading experience but also contributes significantly to your trading success.

Key Features of a Good Forex Trading Platform

Not all trading platforms are created equal, and selecting the right one is a critical step toward successful Forex trading. The key features that should be available on your platform can significantly enhance your trading experience. Having these features not only simplifies the trading process but also helps traders make more informed decisions. Before choosing a platform, it’s essential to research the features it offers and how they can assist you in your trading strategies.

Here are some key features to look for when selecting a Forex trading platform:

- User Interface and User Experience (UI/UX): The platform should be intuitive and easy to navigate. This allows you to quickly find the tools and data you need without getting lost in complicated menus. If the platform is overly complex, it may distract you from trading and lead to missed opportunities.

- Speed and Performance: In Forex trading, time is money. A platform that lags can lead to missed trades and significant frustration. Look for platforms that provide fast execution speeds and reliable performance, especially during periods of high volatility.

- Security Features: In today’s digital age, security is paramount. Ensure your trading platform employs robust security measures such as two-factor authentication and encryption to protect your personal and financial information. This will help you avoid data breaches and financial losses.

- Availability of Tools and Resources: A good Forex trading platform should provide access to a variety of tools and resources, including charts, indicators, and educational materials. These resources help traders analyze the market more effectively and make informed decisions.

User Interface and User Experience (UI/UX)

The user interface (UI) and user experience (UX) are crucial components of a successful trading platform. If the platform’s interface is cluttered and complicated, it can distract you from trading and lead to mistakes. The platform should be designed to ensure that all essential tools and information are easily accessible. For instance, customizable toolbars and straightforward menus can significantly enhance your trading efficiency. If you find it challenging to navigate, you may miss out on valuable trading opportunities.

Moreover, a quality UI/UX can boost your confidence as a trader. When you feel comfortable with the platform, you can focus more on market analysis and decision-making. Some platforms even offer tutorials and user support, which can be particularly beneficial for beginners. A user-friendly interface encourages experimentation with new strategies, ultimately leading to more successful trades.

Speed and Performance

Speed and performance of a trading platform are vital for a trader’s success. In the Forex market, even a slight delay can lead to significant financial losses. During periods of high volatility, having a platform that executes trades quickly and reliably is crucial. When the market is moving rapidly, fast order execution can mean the difference between profit and loss. If your platform is slow or lags, you risk missing out on prime trading opportunities, which can be incredibly frustrating.

It’s also important to consider how the platform performs during peak trading times. Many traders will be active during these times, and if the platform struggles to handle the increased load, it can result in delays or even crashes. Look for platforms known for their high execution speeds and stable performance under stress. This will help you avoid unnecessary stress and allow you to focus on successful trading strategies.

Security Features

Security is one of the most critical aspects to consider when selecting a trading platform. In an age where cybercrime is rampant, it’s essential that the platform you choose employs robust security measures to protect your data and finances. One effective security feature is two-factor authentication (2FA), which requires users to verify their identity through a secondary method, such as a code sent via SMS. This significantly reduces the risk of unauthorized access to your account.

Additionally, it’s crucial that the platform utilizes encryption for data protection. This ensures that your personal and financial information remains confidential. Always verify that the platform complies with industry security standards and offers reliable data protection protocols. Reading reviews from other traders about the platform’s security reputation can also give you insight into its reliability. By choosing a platform with strong security features, you can focus on trading confidently, knowing your assets are protected.

Steps to Optimize Your Forex Trading Platform

Now that we’ve covered the key features, let’s discuss how you can optimize your Forex trading platform step by step.

Choosing the Right Platform

The first step in optimizing your trading experience is choosing the right Forex trading platform. With numerous options available in the market, it’s crucial to take your time and evaluate which platform aligns best with your trading needs and preferences. Start by researching different platforms and reading reviews to understand their strengths and weaknesses. The right platform should not only offer a user-friendly interface but also provide essential features tailored to your trading style.

Consider your trading habits: Are you a day trader, swing trader, or a long-term investor? Each trading style has different requirements. For example, day traders typically need a platform that offers quick order execution and real-time data, while long-term investors may prioritize comprehensive analytical tools and reporting features. Make a list of your trading priorities and use it as a guide to assess different platforms.

| Step | Considerations | Notes |

| 1. Choosing the Right Platform | – User Interface – Execution Speed |

Ensure the platform is easy to navigate and quick to execute trades. |

| 2. Consider Your Trading Style | – Day Trader – Swing Trader – Long-term Investor |

Select a platform that caters to your specific trading style for optimal performance. |

| 3. Evaluate Features and Tools | – Advanced Charting – Automated Trading Systems – Real-time News Updates |

Look for features that will enhance your trading strategy and provide necessary insights. |

Consider Your Trading Style

Understanding your trading style is vital in the optimization process. Your approach to trading will significantly influence the features you require from a platform. Day traders, who capitalize on short-term price movements, often benefit from platforms that provide fast execution speeds and access to real-time data. These traders need to act quickly, so a platform that offers efficient order placement and instant updates on market conditions is essential.

On the other hand, swing traders who hold positions for several days or weeks may prioritize platforms with robust analytical tools, allowing them to analyze longer-term trends effectively. Long-term investors, similarly, might seek platforms that offer comprehensive reporting features and in-depth research tools to help them make well-informed decisions. Understanding your trading style not only helps in choosing the right platform but also plays a critical role in formulating your overall trading strategy.

Evaluate Features and Tools

Once you’ve narrowed down your platform options, the next step is to evaluate the features and tools each platform offers. This requires thorough research to ensure that the platform you choose provides the tools necessary for your trading strategy. Look for advanced charting options that allow you to customize your charts and use various indicators to analyze price movements effectively. The ability to set up automated trading systems can also enhance your trading efficiency, as these systems can execute trades on your behalf based on predefined criteria.

In addition, consider platforms that provide real-time news updates. Staying informed about market-moving news can give you a competitive edge. Events such as economic releases, geopolitical developments, and central bank announcements can significantly impact currency prices. A platform that integrates news feeds directly into the trading interface allows you to make timely decisions based on current events. Ultimately, a platform with the right combination of features will empower you to optimize your trading strategy and achieve better results.

Strategies for Effective Trading

Optimizing your platform is just one part of the equation; you also need effective strategies to succeed in Forex trading. Implementing sound trading strategies can significantly improve your chances of success in the Forex market.

Risk Management Techniques

One of the most crucial aspects of successful trading is effective risk management. It’s essential not to put all your eggs in one basket! Utilizing risk management techniques helps protect your capital and can prevent devastating losses. A common method is setting stop-loss orders, which automatically close a trade when the market reaches a certain price level. This ensures that you limit your potential losses and take the emotion out of your trading decisions.

Additionally, diversification is a key principle in risk management. By spreading your investments across different currency pairs or even other asset classes, you can reduce your exposure to any single market event. If one trade doesn’t go as planned, other trades may still perform well, balancing out your overall portfolio. Establishing clear risk management rules and adhering to them consistently is crucial for maintaining long-term success in Forex trading.

Analyzing Market Trends

Staying informed about market trends and news is vital for making educated trading decisions. Understanding economic indicators, such as unemployment rates, inflation data, and GDP growth, can provide valuable insights into currency movements. For example, if a country’s employment figures improve, it could strengthen its currency as investor confidence grows.

Moreover, global events, such as geopolitical tensions or central bank decisions, can significantly influence currency prices. Keeping an eye on major news sources and economic calendars can help you anticipate market movements and position yourself accordingly. Many platforms offer integrated news feeds or economic calendars that can keep you updated on important events. By analyzing market trends and staying informed, you can make better trading decisions and enhance your overall trading strategy.